Bitcoin Ordinals: NFTs on OG Crypto

The Power of Bitcoin Ordinals: Analyzing Trends and Predicting Market Changes

If you're interested in cryptocurrencies, you've probably heard about Bitcoin, the world's first and most valuable cryptocurrency. Since its creation in 2009, Bitcoin has gained massive popularity and has become a household name. It has attracted much attention due to its unique properties and potential to revolutionize the financial industry. In this article, we will explore the concept of Bitcoin ordinals and how they can be used to enhance Bitcoin's functionality.

What's in an ordinal?

Bitcoin ordinals are a concept that was introduced to the Bitcoin protocol in 2015. They are essentially a way of numbering transactions on the Bitcoin blockchain. Each transaction on the Bitcoin network is assigned a unique identifier, which is known as a transaction ID or TXID. The TXID is a hash of the transaction data, which ensures that each transaction is individual and cannot be altered without invalidating the hash.

Bitcoin ordinals take this further by assigning a unique number to each transaction, starting from the Genesis block. The genesis block is the first block on the Bitcoin blockchain, with a block height of 0. The block height of subsequent blocks increases by 1 for each new block added to the blockchain.

Bitcoin ordinals are based on the block height that includes the transaction. Bitcoin Ordinals are also used as a unique tool by traders and investors to analyze the Bitcoin market. For example, if a transaction is included in block 100, its ordinal number would be 100. This allows for easy referencing of transactions and makes it easier to track the movement of funds on the Bitcoin network.

Ordinal inscriptions are essentially a method of storing data on the timestamps of the block created. This allows images and videos to be stored as data on the blocks. This can further be sold as NFT. Ordinal inscriptions being sold as NFTs (non-fungible tokens) is a new trend in the world of cryptocurrency and blockchain. The concept behind ordinal inscriptions as NFTs is similar to that of other types of NFTs, such as digital art or collectibles. Instead of representing a unique piece of art, an ordinal inscription NFT represents the blocks on which the art has been inscribed on the Bitcoin blockchain.

How do Bitcoin Ordinals work?

Bitcoin ordinals have revolutionized the way transactions take place on the Bitcoin blockchain. They are based on the theory of ordinals, which assigns a unique numerical system to satoshis (sats), the smallest unit of Bitcoin.

Ordinals theory has given sats a new dimension of life, enabling them to be viewed as atomic units that can be used to form Bitcoin ordinals. This has opened up new opportunities in the cryptocurrency world, allowing for the creation of digital collectibles that are unique, valuable, and immutable.

Ordinals theory is the driving force behind the creation and operation of Bitcoin ordinals. This theory defines satoshis (sats) as the atomic unit of the Bitcoin network, which can be identified and traded individually. It is based on the premise that sats are divisible units that can be uniquely identified and categorized using ordinal numbers.

There are 100 million sats that make up one Bitcoin, and each sat can be individually numbered based on the order of mining. This unique identification number, which is an ordinal number, is what makes it possible to create and trade Bitcoin ordinals.

The use of ordinal numbers allows for greater precision and accuracy in tracking and managing transactions on the Bitcoin network. It enables users to identify and distinguish between different sets, even when they are part of a larger transaction.

The process of creating a Bitcoin ordinal is relatively straightforward. A sat is assigned a unique ordinal number, which is then engraved with digital content to represent a particular asset or cryptocurrency. Once the ordinal is created, it becomes a digital collectible that can be traded and exchanged using Bitcoin wallets on the blockchain network.

The use of ordinal inscriptions in Bitcoin transactions has also enabled the creation of more sophisticated applications such as security tokens, accounts, and stablecoins. These applications use ordinal numbers as stable identifiers, enabling users to track and manage their assets with greater precision and accuracy.

How to create Bitcoin Ordinals?

Use an ordinals-compatible Bitcoin wallet. You need an ordinal address to transfer your to-be-inscribed satoshi. You need cryptocurrency wallets to store, manage, and transact cryptocurrencies such as Bitcoin, Ethereum, etc. Ordinals Wallet, Hiro Wallet.

Select the kind of inscription that you want to create. Remember that the data will be forever on the blockchain.

Upload the file or image.

Select the fee. The lower the fee, the longer it will take for the Bitcoin NFT to be created.

Click “Pay & Inscribe.” You will see a QR code with the payment address.

Once you have paid and inscribed your data onto the blockchain, you will receive your Bitcoin ordinal.

Historical Trends and Data:

The trend of selling ordinal inscriptions as NFTs has been gaining popularity in the world of cryptocurrency and blockchain. The demand for these NFTs has been steadily increasing over the past few years, with some notable events driving their popularity.

The first instance of any kind of art or inscription found on the Bitcoin blockchain was a project by Dan Kaminsky. In 2011, message inscriptions were found on the various blocks of the Bitcoin blockchain. Messages from the Mines is a project that explores the hidden messages that have been embedded in the Bitcoin blockchain.

On May 3rd, 2014, Quantum was the first NFT according to Sotheby’s. In April 2015, Harm Van Den Dorpel claims to be the first artist to sell an NFT to an institution for Bitcoin. In October 2015, Etheria is considered to be the first pixel-on-chain NFT ever created. In the same month, we observed the rise of Source 2, widely considered the first digital land as NFT. 2016 saw the first audio NFTs, while 2017 brought us CryptoPunks and EtherRock. Experiments with Bitcoin NFts and other kinds of NFTs are an interesting aspect to explore. We reach the conclusion that the first NFTs might be much older than mass belief.

Yuga Labs, a blockchain-based gaming and collectibles company, recently launched a collection of Bitcoin ordinal NFTs known as the Twelvefold Collection. This collection consists of 12 unique Bitcoin ordinal NFTs, each representing a different power of 12 in the Bitcoin ordinal system.

The Twelvefold Collection was created as a way to showcase the unique properties of Bitcoin ordinals and to provide collectors with a rare and valuable collection of NFTs. Each NFT in the collection has a distinct design and color scheme, with the ordinal number prominently displayed on the front.

The release of the Twelvefold Collection was met with great enthusiasm from the cryptocurrency community, with the NFTs selling out within minutes of their launch. The first auction for Yuga Labs’ TwelveFold collection netted $16.5 million in sales. The top bid was nearly $160K.

In addition to these high-profile sales, there have been numerous other transactions and trades of Bitcoin ordinal NFTs. The market for these NFTs is driven by collectors and investors who see them as a unique and valuable digital asset. The use of blockchain technology to verify the authenticity and ownership of these NFTs adds to their perceived value and helps to establish a market for them.

Overall, the trend of selling ordinal inscriptions as NFTs has been a significant development in the world of cryptocurrency and blockchain. The increasing demand and high prices paid for these NFTs demonstrate their potential as a valuable digital asset. As the market for Bitcoin ordinal NFTs continues to grow, it is likely that we will see even more notable sales and transactions in the future.

Analysing Bitcoin Ordinals:

Bitcoin ordinals have emerged as a popular type of NFT, and their impact on the cryptocurrency and blockchain ecosystem cannot be ignored. These unique digital collectibles represent a unique set of digital collectibles within a specific category and are bought, sold, and traded on the native blockchain platform.

It is remarkable to note that there have been over 4 million Bitcoin ordinal inscriptions to date. This indicates that there is a significant demand for these digital collectibles, and people are willing to pay a premium for them. In fact, the fees collected from Bitcoin ordinals have surpassed the $20 million mark, which is a testament to their growing popularity.

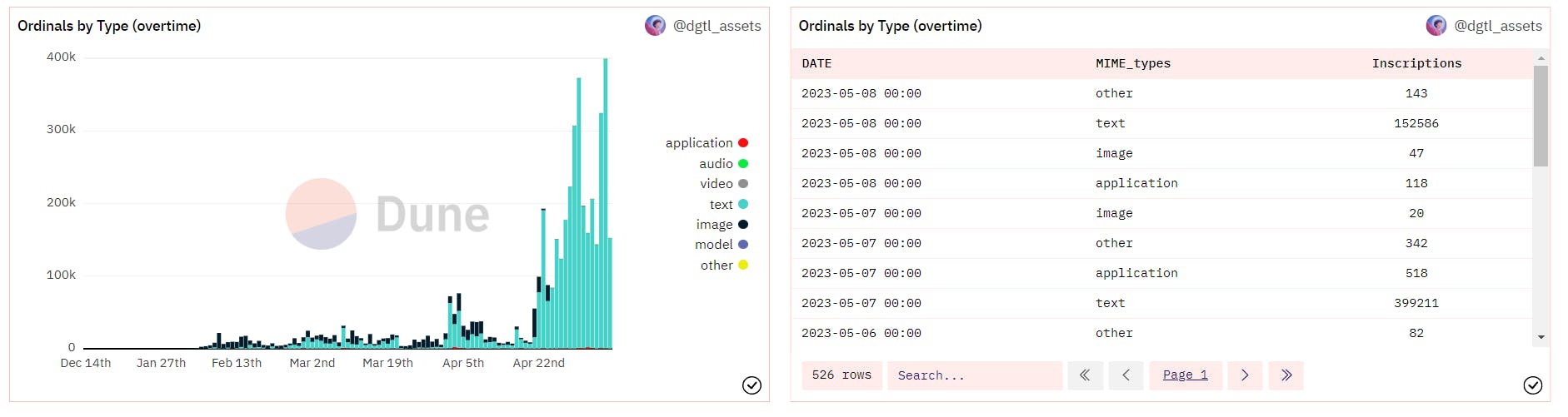

Over the years, Bitcoin ordinal inscriptions have gained significant traction in the cryptocurrency and blockchain world. As we can see in the charts above, the Bitcoin inscriptions and fees paid have exponentially increased.

The rise of Bitcoin Ordinal inscriptions can be attributed to several factors. For one, as the cryptocurrency market continues to expand, investors and enthusiasts are constantly seeking new ways to distinguish themselves and their investments. Bitcoin ordinal inscriptions provide a unique way to stand out from the crowd by displaying a personalized ranking of one's cryptocurrency holdings.

Analysis Source: https://dune.com/dgtl_assets/bitcoin-ordinals-analysis

The Aggregate Inscriptions by MIME Type data provides valuable insights into the types of content being transacted using Bitcoin ordinals. The top 5 categories by the number of inscriptions are text/plain;charset=utf-8, image/png, image/webp, image/jpeg, and application/json.

With 3,961,513 inscriptions, text/plain;charset=utf-8 is the most prevalent MIME type in Bitcoin ordinals. This is likely due to the fact that text is a fundamental element of communication and can be easily transacted on the Bitcoin network.

Coming in second is image/png with 476,449 inscriptions. This indicates that image files are also commonly transacted on the network. The popularity of image/webp and image/jpeg, with 105,112 and 46,456 inscriptions respectively, further supports this observation.

Application/json is the fifth most common MIME type with 20,989 inscriptions. This indicates that JSON, a lightweight data interchange format, is also being transacted on the network. JSON is commonly used in web and mobile applications and can be used to transmit data between servers and clients.

Other MIME types with significant numbers of inscriptions include image/svg+xml, text/html;charset=utf-8, and image/gif. While these categories may not have made it into the top 5, they still indicate the diversity of content being transacted on the Bitcoin network.

Overall, the Aggregate Inscriptions by MIME Type data highlight the versatility of Bitcoin ordinals and the wide range of content that can be transacted on the network. It also demonstrates the exponential growth of the Bitcoin ordinal market and the increasing demand for immutable digital collectibles.

Analysis Source: https://dune.com/dgtl_assets/bitcoin-ordinals-analysis

Ordinal marketplaces have been gaining significant popularity in recent years, providing an avenue for users to buy and sell Bitcoin ordinals. The charts above show a varied amount of marketplaces dominating different sectors.

Ordswap is a platform that has been gaining traction in the ordinal market. It is a peer-to-peer platform that allows users to buy and sell Bitcoin ordinals directly with each other.

Open Ordex is also a decentralized platform for trading Bitcoin ordinals. The platform offers a user-friendly interface and a wide range of trading tools for users. The platform might be struggling now, but it does possess a loyal customer base.

Gamma is a platform that allows users to create, buy, and sell custom Bitcoin ordinals. The platform has seen a surge in users over the past year, with the line graph showing an increase in its user base.

Magic Eden is a peer-to-peer marketplace for buying and selling Bitcoin ordinals. The platform offers a wide range of Bitcoin ordinals and has been gaining popularity over the past few years. There has been an exponential increase in the user base of Magic Eden as compared to other marketplaces offering Bitcoin Ordinals.

Pros and Cons of Bitcoin Ordinals:

Pros:

One of the key advantages of Bitcoin ordinals is the ability to attract new users to the network. By enabling the creation and trade of NFTs on the Bitcoin network, it can capture market share from other smart contract chains and draw value into Bitcoin, which was previously excluded from it. This can also encourage users who were previously uninterested in Bitcoin to purchase it and pay inscription fees, move their NFTs around, and trade them with others, thereby driving demand for Bitcoin.

Furthermore, the popularity of Bitcoin ordinals is a testament to its market demand. Inscription transactions take up space on the blockchain that would otherwise be filled by standard Bitcoin transactions. The fact that there has been an uptake in inscription transactions indicates that there is market demand for them. If inscription transactions were a poor use of block space, they would slow down or be priced out as miners would prefer to include standard transactions in blocks, making ordinal transaction bidding much higher.

One of the key advantages of Bitcoin ordinals is the ability to attract new users to the network. By enabling the creation and trade of NFTs on the Bitcoin network, it can capture market share from other smart contract chains and draw value into Bitcoin, which was previously excluded from it. This can also encourage users who were previously uninterested in Bitcoin to purchase it and pay inscription fees, move their NFTs around, and trade them with others, thereby driving demand for Bitcoin.

Furthermore, the popularity of Bitcoin ordinals is a testament to its market demand. Inscriptions transactions take up space on the blockchain that would otherwise be filled by standard Bitcoin transactions. The fact that there has been an uptake in inscription transactions indicates that there is market demand for them. If inscription transactions were a poor use of block space, they would slow down or be priced out as miners would prefer to include standard transactions in blocks, making ordinal transaction bidding much higher.

Bitcoin ordinals also drive more fees for miners. The high demand for popular NFT projects like CryptoPunks and Bored Ape Yacht Club NFTs has led to increased transaction fees. This generates more income for miners and improves Bitcoin's overall security model by providing income for miners after the Bitcoin block subsidy shrinks with each halving.

In addition, inscription transactions can accelerate the adoption of second-layer solutions like the Lightning Network. As more users adopt Bitcoin and fill up the blocks, certain transactions will be priced out due to the high fees. This will force bitcoiners to fast-track improvements of second-layer solutions like the Lightning Network.

Lastly, Bitcoin ordinals can drive adoption of taproot transactions. Taproot transactions have not yet seen much uptake despite its benefits in providing more compact transactions and better privacy. However, since the launch of ordinals, we have seen a sharp rise in Taproot transactions. Ordinal promoters believe that it will help push more wallets and users to opt for taproot transactions as block space is limited.

Overall, Bitcoin ordinals provide several benefits to the Bitcoin network. It attracts new users, increases demand for Bitcoin, generates more fees for miners, accelerates the adoption of second-layer solutions, and drives the adoption of taproot transactions.

Cons:

One of the main arguments against the use of ordinals in Bitcoin is that it could drive up the cost of block space, making it more expensive for node operators to run full nodes. This, in turn, could lead to higher fees and chain bloat, ultimately leading to further centralization of the network. As more people adopt ordinals, there could be constant fee pressure, driving up the floor on transaction costs and making it harder for those who want to make on-chain transactions to do so without paying exorbitant fees.

Another concern is that the use of ordinals could bring in more speculation to the Bitcoin network. As we've seen with popular NFT projects like CryptoPunks and Bored Ape Yacht Club, the novelty of using Bitcoin to host NFTs has led to outrageous bids and speculation. This could lead to a shift in capital flow away from storing value in Bitcoin and towards trading ordinals. Serious investors may also steer clear of Bitcoin, seeing it as another digital pet project not to be taken seriously.

Furthermore, adding non-fungible attributes to satoshis could affect Bitcoin's fungibility. The NFT file and the satoshi attached to it render it distinct from satoshis without an inscription tethered to it. This could result in a market for rare collectible satoshis versus standard satoshis, challenging Bitcoin's use case as money by affecting the fungibility of satoshis in the network.

Additionally, the use of ordinals could add additional tracking to Bitcoin. By creating a serial number for satoshis and adding additional data that can be attributed to a wallet and its Bitcoin, users are effectively advertising themselves online and making their on-chain behavior easier to track. This could undermine the privacy of Bitcoin, which is pseudonymous rather than anonymous.

Finally, there is the concern that inscriptions could be pruned, potentially leading to the loss of valuable data. Bitcoin nodes are not required to keep signature data, and if nodes achieve consensus on pruning certain witness data, proof of the inscription could be lost. This could lead to nodes specializing in storing all inscription data or companies and individuals operating a node keeping their own copies of transaction records. However, this goes against the decentralized, trustless nature of Bitcoin, as it creates a federation or custodian for ordinals and inscriptions.

In summary, while the use of ordinals in Bitcoin could bring some benefits, such as adding non-financial data to the blockchain, there are also significant cons to consider. These include driving up the cost of block space, bringing in more speculation, affecting Bitcoin's fungibility, adding additional tracking, and potentially creating a centralized authority for ordinals and inscriptions. Ultimately, the decision to use ordinals in Bitcoin should be carefully weighed against these potential drawbacks.

Future of Bitcoin Ordinals:

The rise of ordinals on Bitcoin has brought many opportunities for developers and users alike. By using the Bitcoin blockchain to permanently record data, digital objects such as artwork can now have verifiable ownership. But it's not just art that can benefit from this development, domain addresses can also be created using this technology.

However, using the blockchain can be challenging for some users. Public wallet keys, in particular, can be long, intimidating strings of random numbers and letters, which can lead to mistakes and lost crypto.

To make crypto transactions more user-friendly, developers have been working on solutions such as Ethereum Name Service (ENS), which turns wallet addresses into easily readable domain names. But until recently, there was no comparable solution for the Bitcoin network.

Enter BTCDomain. This platform uses ordinals and zk-STARKs to generate unique domain addresses that can be used on the Bitcoin network. Ordinals are unique inscriptions in Bitcoin transactions that can be verified using a blockchain explorer. BTCDomain uses this approach to associate Bitcoin domain addresses and contains all the necessary metadata within a Bitcoin transaction.

To ensure that transactions are resolved correctly, BTCDomain uses zk-STARK technology to generate a zero-knowledge proof.

Epilogue:

In conclusion, Bitcoin ordinals have emerged as a promising new development in the world of cryptocurrencies. By assigning unique identifiers to every satoshi on the Bitcoin network, ordinals allow for unprecedented levels of granularity and precision in tracking transactions and analyzing blockchain data.

While still in the early stages of development, Bitcoin ordinals have already shown great potential for improving the transparency, security, and efficiency of the Bitcoin network. As more developers and users begin to explore the possibilities of this new technology, we can expect to see even more exciting innovations and use cases emerge in the years ahead.

As with any new technology, there are sure to be challenges and obstacles along the way. However, the benefits of Bitcoin ordinals are clear, and it is likely that they will become an increasingly important part of the cryptocurrency landscape in the coming years.

Whether you are a seasoned Bitcoin enthusiast or just starting to explore the world of cryptocurrencies, it is worth keeping an eye on the exciting developments taking place in the world of Bitcoin ordinals. Who knows what new and innovative applications we will see in the future? The possibilities are truly endless.